- List Price $849,000

- Price / Unit $141,500

- Property Type Multifamily

- Units 6

- Current Rents $78,900

- Pro Forma Rents $104,400

- In Place NOI $48,618

- Projected NOI $66,662

- Target CAP Rate 5.7%

- Market CAP Rate 5%

- Today's Market Value $972,367

- Value w/Market Rents $1,333,242

*Today’s Market Value & Value w/Market Rents is a theoretical value calculation derived by NOI and CAP rate. It does not take any other property factors into account.

- 9

- Bedrooms

- 6

- Bathrooms

- 7000

- Sq Ft

- 1969

- Year Built

- 100%

- Occupancy

- 8

- Parking

- 3

- Stories

- Boiler Heat

- Heating System

- Window Units

- Cooling System

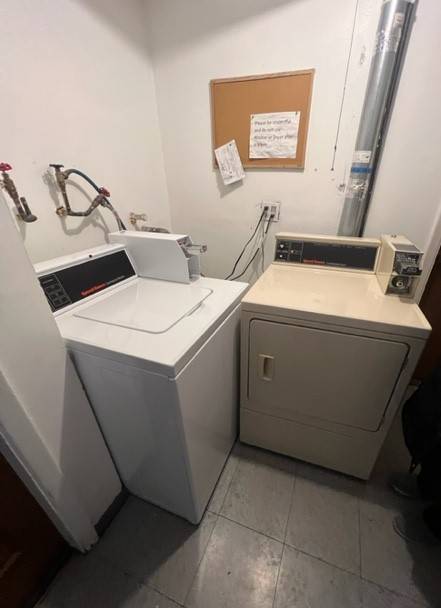

- Common, Paid

- Laundry

9

- Bedrooms

6

- Bathrooms

7000

- Sq Ft

- 1969

- Year Built

- 100%

- Occupancy

- 9

- Parking

- 3

- Stories

- Boiler Heat

- Heating System

- Boiler Heat

- Cooling System

- Common, Paid

- Laundry

About the property

Exceptional investment opportunity: This 6-unit property is in impeccable condition in both the interior and exterior. The building has been in the hands and management of the original owner and has been maintained extremely well for over 50 years. This is a stable investment, with loyal tenants, some with over 15+ years in the building. Rents are below market and have significant upside. Some of the major improvements done over the years include new asphalt paving in 2023, new roof in 2010, new attic insulation in 2020, new hot water heater in 2018, hallway and inside staircase remodel in 2021, which includes new carpet, new paint and decorative wall paneling. Additionally, the current owner has been heavily involved in the city’s crime prevention measures and has gone above and beyond to ensure tenant and building safety. This includes the installation of an intercom system and double bolt locking system on exterior doors. This is truly a rare opportunity to own a stable investment in one of the most desired Chicago land area suburbs. Inquire for more information on rent roll, financials and to schedule a tour with 48–72-hour notice.

About the neighbourhood

- Just a 15-20 minute drive from Downtown Chicago, Rosemont, Illinois, is a vibrant suburban enclave pulsating with energy and entertainment. Renowned for its accessibility, Rosemont boasts proximity to O'Hare International Airport, making it a hub for travelers and locals alike. This dynamic community seamlessly blends modernity with tradition, offering a myriad of attractions, from world-class shopping at the Fashion Outlets of Chicago to adrenaline-pumping experiences at the MB Financial Park, home to entertainment venues, restaurants, and nightlife hotspots. Within a 15-20 minute drive to Downtown Chicago, Rosemont offers convenient access to the bustling heart of the city's cultural and business landscape.A big part of Rosemont's allure lies in its iconic Rosemont Convention Center, a premier destination for conferences, trade shows, and events. Investors seeking opportunities in Rosemont will find the Convention Center's significance to the local economy and its role as a magnet for business and tourism compelling. Whether indulging in gourmet dining, catching a concert, or exploring the scenic parks and recreational facilities, Rosemont promises an unforgettable experience for residents and visitors alike, enriched by its proximity to Downtown Chicago and the prominent presence of the Rosemont Convention Center.

Municipality - Investor Guide

Rosemont

| Transfer Stamps | Pre Sale Inspection | Yearly Rental Inspection | |

|---|---|---|---|

| Buyer: N/A | Cost: - | Required: No | Required: No |

| Seller: N/A | Cost: - | Cost: $0 | Cost: $0 |

For a list of all Municipality requirements visit our Municipality Requirements Page

Property Financials

View current and future return metrics based on customizable inputs. "Annual Net Income", "Monthly Cash Flow", "Cash on Cash Return", "Equity Value", and "Equity Multiple" are based off of the "Year 2 Pro Forma" column inputs.

Property Current

This column shows the current financial state of the subject property. Some of these inputs may be estimations.

Year 2 Pro Forma

This column is based off of market rents and assumes proper property performance.

Debt Service

This column allows the user to add custom financing scenarios.

Mortgage Calculator

- Down Payment

- Loan Amount

- Monthly Mortgage Payment

- Monthly Property Tax

- Monthly Property Insurance

- Monthly HOA Fees

Utility Table

Total Yearly Utitlity Cost: $5,929.00

*This Utility Table does not include snow removal or lawn care costs, if any. For more details on snow/lawn expenses, see the "Expenses" attachment located under the "Property Documents" section.

Property Taxes

| 2022 | 2021 | 2020 | 2019 | |

|---|---|---|---|---|

| Tax Amount | $8,535.18 | $15,518.51 | $16,142.59 | $15,165.98 |

| YOY Tax Change ($) | -$6,983.33 | -$624.08 | +$976.61 | +$957.92 |

| YOY Tax Change (%) | -45.00% | -3.87% | +6.44% | +6.74% |

| Current Assessed Value | $69,000 | Source - Public Record For more information on assessments, property taxes, and tax appeals visit: Property Taxes | Assessed - Land | $8,400 | Assessed - Improved | $60,600 |

For more information on assessments, property taxes, and tax appeals visit: Property Taxes

Walkscore

Nearby

- Arts & Entertainment

-

Cavaliers Drum & Bugle Corps (0.06 mi)Exceptional 1 reviews

-

VHT Studios (0.22 mi)Average 25 reviews

-

OLC Education & Conference Center (0.3 mi)Exceptional 3 reviews

- Education

-

NetXperts (0.32 mi)Poor 12 reviews

-

One Hope United - O'Hare Child Development Center (0.33 mi)Exceptional 6 reviews

-

Sure Win Real Estate Education (0.39 mi)Average 15 reviews

- Food

-

TGI Fridays (0.17 mi)Fair 236 reviews

-

Farmer's Fridge (0.23 mi)0 reviews

-

Networks Restaurant (0.29 mi)Good 5 reviews

- Health & Medical

-

Dental Group of Rosemont (0.13 mi)Exceptional 1 reviews

-

Aerotek Professional Services (0.21 mi)Fair 13 reviews

-

Robert Half (0.25 mi)Average 10 reviews

Contact Information

- List Price $849,000

- Property Type Multifamily

- Current Rents $78,900

- In Place NOI $48,618

- Target CAP Rate 5.7%

- Today's Market Value $972,367

- Price / Unit $141,500

- Units 6

- Pro Forma Rents $104,400

- Projected NOI $66,662

- Market CAP Rate 5%

- Value w/Market Rents $1,333,242

*Today’s Market Value & Value w/Market Rents is a theoretical value calculation derived by NOI and CAP rate. It does not take any other property factors into account.

Similar Listings

HOT – 11 Units – Rockford, IL – Value Add

- $875,000

- $79,545 / Unit

Multifamily

Units: 11

Beds: 33

Baths: 16.5

9834 Sq Ft